Our Result-Driven Payroll Management Sources

We bring clarity, compliance, and confidence to every payroll cycle.

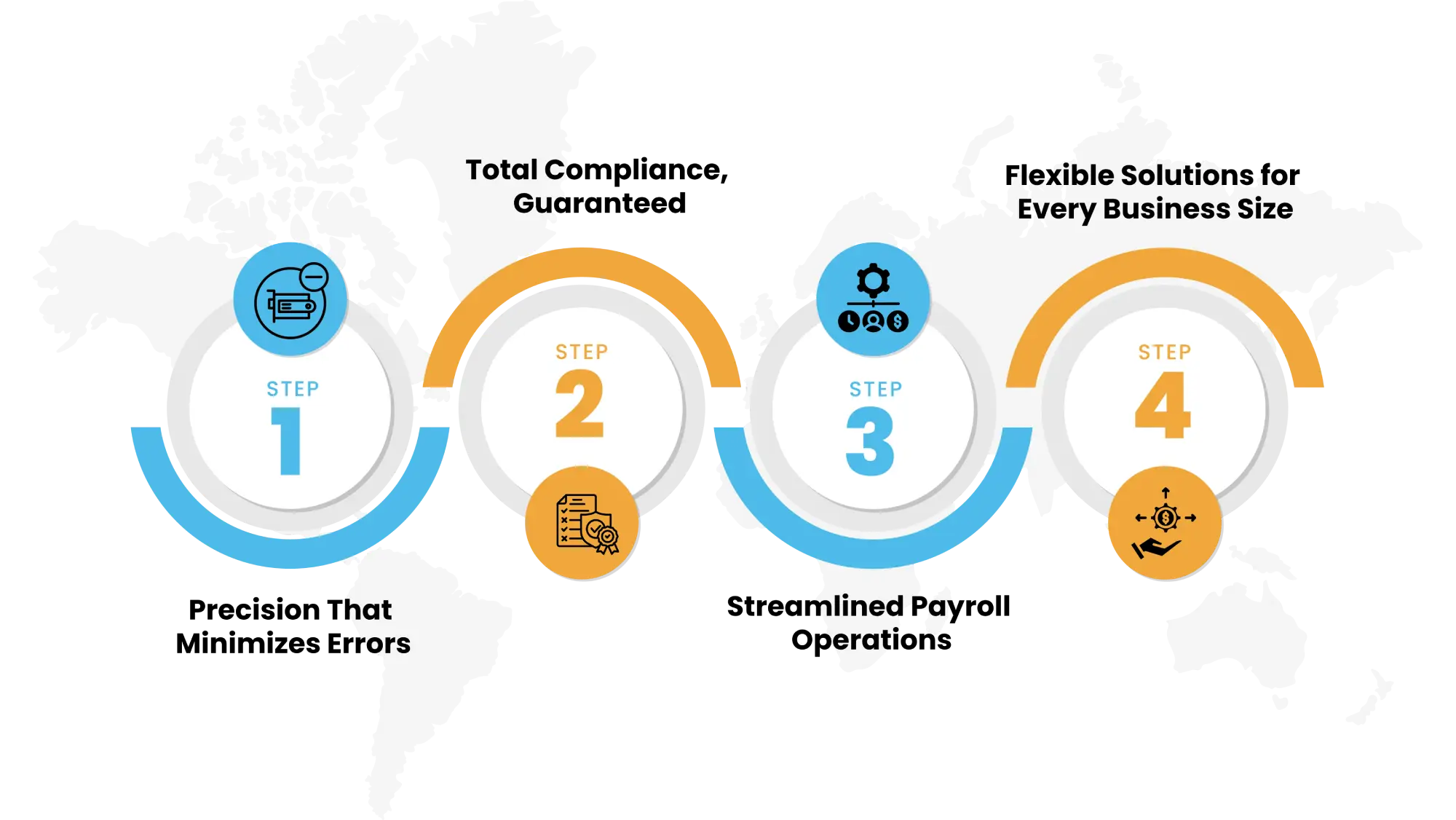

Accuracy That Builds Trust.

Compliance You Never Have to Worry About.

Cut down manual work & speed up execution.

Scalable Payroll Solutions for Business Types.

From fast-growing startups to large enterprises with multi-state teams, Priyam Consultancy Services delivers seamless payroll execution through a blend of automation and human expertise. We’re not just a payroll vendor-we’re your strategic partner in building compliant, stress-free HR operations. Whether you’re managing a small business or a large scale, our scalable systems ensure salary processing, tax filing, statutory reporting, and team support-all run smoothly and securely.

We don’t just process payroll. We power it with precision, compliance, and care.

Get Your Free Quote

We bring clarity, compliance, and confidence to every payroll cycle.

End-to-end salary management—from inputs to disbursals.

A dedicated team that runs payroll, so your HR can focus on people.

When you need more than execution, you need optimization.

A 360° payroll solution built for precision, compliance, and continuous optimization.

To begin, we will meticulously examine your current payroll system, employee data, and compliance situation. This audit gives us insight into any flags or gaps in your business. We will look at your overall payroll structure initiating with accuracy of data, statutory compliance and whether there are unnecessary inefficiencies in your workflow.

We don’t believe in one-size-fits-all solutions. That’s why we spend the time tailoring our payroll management system to fit your business perfectly. We customize salary structure, tax calculations and other compensation based on your organization's internal policies.

With accuracy and efficiency we will process all stages of the payroll cycle - from data entry to payout. Begins with checking data entry where we ensure that attendance and leave balances and any other elements being entered onto payroll are accurate to the day. We will calculate salaries, benefits, bonuses, and deductions according to your company policies.

Keeping up with regulations that are constantly changing can be tough, but we have got you covered! We take responsibility for all statutory filings (PF, ESI, TDS, PT, etc) and file all required documents on time. We also produce Form 16s and quarterly/year-end reports with complete documentations of all transactions.

We view payroll management as an ongoing journey, not a one-time task. That’s why we don’t stop at execution we continuously optimize. Each cycle is reviewed closely to track outcomes, spot inefficiencies, and make timely improvements that keep your payroll process sharp and dependable.

At PCS, payroll management is an ongoing partnership, not just processing. Our dedicated team is always available to help with questions, fix issues, or discuss anything you need. We'll also provide proactive assistance with your payroll data, helping you see trends, risks, and possible savings.

Priyam Consultancy Services streamlines payroll so you can do what really matters – look after your people and grow. With our accuracy-first approach, we verify every calculation from salaries to deductions, reduce errors, and pay on time. Your employees are paid accurately every time.

Stay updated with the latest in HR services, HR strategy and payroll management.